Witthaya Prasongsin/Getty Images

- A dividend yield is a ratio — expressed as a percentage — that shows how much a company pays its shareholders in dividends relative to its share price.

- Dividend yield can help investors evaluate the potential profit for every dollar they invest, and judge the risks of investing in a particular company.

- A good dividend yield varies depending on market conditions, but a yield between 2% and 6% is considered ideal.

- Visit Business Insider’s Investing Reference library for more stories.

Dividends are an important benefit to owning stocks, whether you use them for immediate income or reinvest them into more shares. Whichever, you obviously want the biggest payout you can (safely) get for your investment.

But what’s considered a “good” dividend — and how do you identify a company that’s paying one? This is where dividend yield comes in. This financial metric evaluates a dividend payout and provides a way to compare it to those of other stocks.

What is a dividend yield?

As a refresher, dividends are periodic payments that companies make to their shareholders: a piece of the profits as a perk for investing in the organization. Dividends are usually paid out quarterly, but some companies elect to declare and pay investors on a monthly, semi-annual, or annual basis.

Dividend yield is a tool used to calculate the return on the amount of money you’ll receive in dividends from a company, based on the current market price of the stock. In other words, it’s the potential dividend-only value of a stock investment.

While income-seeking investors look for high-dividend stocks to secure a stable cash flow, high and low yields have different meanings depending on a range of market factors, including stock prices, what sector the company is in, and the company’s financial outlook.

For example, a high dividend yield — while it looks good on paper — may actually indicate that a company is experiencing financial troubles. If a stock goes down, but the dividend payout remains the same, it's very possible the high yield is too good to be true.

On the other hand, low dividend yields may signal that the company is focusing on growth and reinvestment, which may not be favorable for the short term, but ideal for the long term.

In this sense, dividend yield isn't necessarily an indicator of "good" or "bad" stocks. Instead, the formula is best utilized for evaluating the risks and rewards of investing in a company and choosing which stocks have the best potential for your investment goals.

How to calculate dividend yield

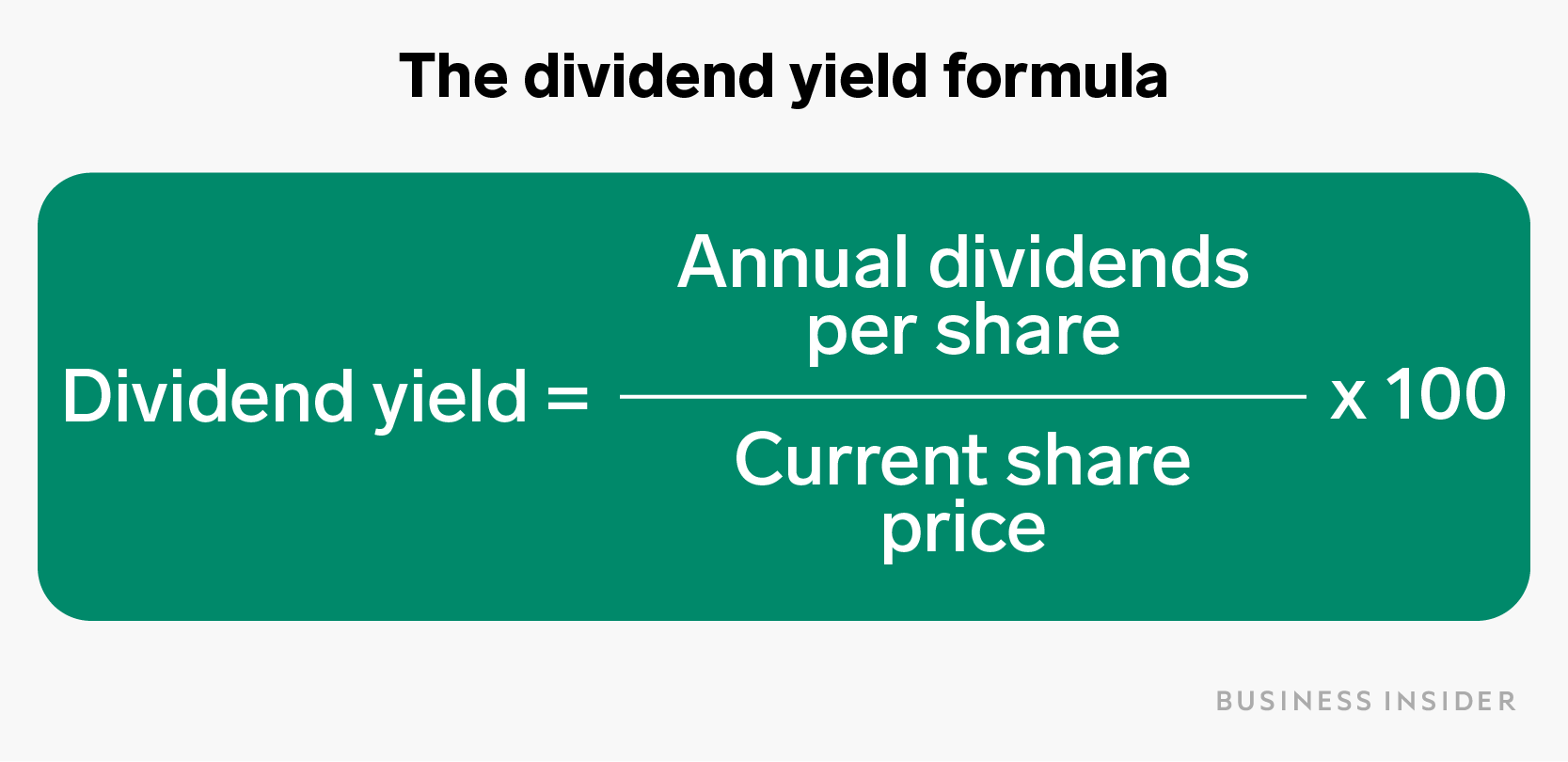

Determining a stock's dividend yield is actually a pretty simple equation.

Shayanne Gal/Business Insider

For example, let's say you own shares of a company currently valued at $100 per share. Assume the company declares its annualized dividend as $4 per share. The company's dividend yield is the annual dividend per share ($4) divided by the current share price ($100) and multiplied by 100, which equals 4%.

To arrive at your annual dividend, total the dividends per share for all periods during the year. If dealing with a quarterly dividend, for example, simply add up each quarter's payout and use that as the annual dividend per share.

When researching companies, online brokers list dividend yields. Market index pages (like those provided by our colleagues at Markets Insider) also typically include dividend yield among its data.

Alternatively, a company's full annual report usually lists the annual dividend per share, so you can calculate it manually.

Evaluating dividend yield

Generally speaking, a dividend yield can help you spot the right investment opportunities for your income needs. More specifically, a dividend yield can help you:

- Compare stocks more accurately: The yield makes it easy to compare the relative value of the stock's share price to its peers. If the yield is in line with its peers in the sector, that's probably a good sign.

- Evaluate a company's financial strength: Dividend yield is the first step to assessing a company's staying power. The most reliable high-dividend stocks come from mature companies that offer dividends that grow year over year. For example, if it's an established blue-chip company in a high-yield sector, high yields are the norm and do not necessarily signal the company is undervalued.

It would be natural to assume that the higher the dividend yield, the better. Often that is true. A higher dividend yield typically means more dividend income for you.

In some cases, however, a high yield doesn't mean the underlying stock is a sound investment. For example, dividend data might be old or incomplete, or it could be a scenario where a company's stock price is falling, but the dividend has remained the same. Both instances lead to a superficial yield inflation.

Consider our example above of the company that pays $4 annual dividend per share at $100 per share. Due to market conditions and poor management, let's say the share price drops to $50. The dividend yield is now 8%. That's a high dividend yield, but not for the right reasons.

What's important to remember is dividend yield tells only part of the story, which is why experts are quick to say that investors should never rely on dividend yield alone to make decisions.

If you do come across a stock with a high dividend yield, it's worth examining past performance to ensure the dividend yield has been consistent.

What's a good dividend yield?

The current average S&P 500 dividend yield is 1.80%. The average between 2008 and 2018 has hovered around 2%. This suggests that a dividend yield of 2% or more would be considered good or at least above average.

And the best-yielding do better than that, often around 4%-5%. To play it safe, a top rate of around 6% or so makes sense: It usually demonstrates the company has reached a growth point where it can generate real income without resorting to borrowing or other self-destructive measures. Solid blue-chip stocks often hover around that number.

So where do you find these deluxe dividend-payers? Industries rich in high-yielding companies, and some of the particular stars and their analysis-anticipated dividend yields include:

- Telecommunications: Companies that provide internet, phone, cable, and satellite services. One venerable dividend-paying telecom stock is Verizon (VZ) (just over 4%).

- Energy: Companies in the business of generating both renewable and non-renewable energy. A good example in non-renewable energy is Chevron (CVX) (6.29%). On the renewable side, Hannon Armstrong (HASI) (2.6%).

- Healthcare: Think medical services and equipment, pharmaceuticals, and insurance. Pfizer (PFE) (4.23% and rising) is one of the most solid citizens.

- Utilities: Companies that provide water, sewer, electricity, dams, and natural gas. For an exemplary stock go no further than Edison International (EIX) (4.21%).

- Consumer staples: Manufacturers of food, beverages, consumable household and personal products. Proctor and Gamble (PG) (a modest but steady 2.12%) is a model for this sector.

- Real estate: Real estate investment trusts (REITs), companies that own, operate, or finance income-producing properties are the vehicle of choice for most investors. National Retail Properties (NNN) (5.9%) is a sterling example.

The financial takeaway

Dividend yield is a good way to value the dividends a company's paying out. But it's only one factor to consider when evaluating income stocks.

Other factors such as market conditions, financial health of the company, and share price fluctuations can affect the validity of dividend yield as an evaluation tool.

If you do account for those other factors, the higher the dividend yield the better – within limits. The recommended dividend yield range to consider when shopping for income stocks is 2% to 6%. But make sure that yield is due to solid fundamentals on the underlying company's part — and not just because the share price is taking a tumble.